We provide following services

Employees' Consultancy Services has evolved to become one of the professional and prominent consultancy services company. We give perfect consultancy solution& services that fits client requirement at competitive rates.

Payroll Services

Payroll Services Provident Fund Registration

Provident Fund Registration ESIC Registration

ESIC Registration Professional Tax Registration

Professional Tax Registration Service Tax

Service Tax Shop & Establishment License

Shop & Establishment License

Get rid of payroll maintenance

ECS has been providing payroll services and human resource solution since many years. Our mission is simple and committed to leveraging our years of payroll and human resource industry experience and leading technology to provide comprehensive, user-friendly payroll and HR services to our clients. We believe every client deserves exceptional, personal service and are committed to exceeding expectations with every client interaction.

- Advice on compensation structuring

- Personal attention to employee in structuring their salary

- Payroll Processing and crediting employee salary accounts

- Issuing Form 16

- Labour Law compliance - ESI, EPF, Professional Tax and other local law - Collection, Payment, filing and representation incl. Handling PF transfers and PF / ESI claims

- Providing MIS Reports and accounting entries as per the requirements of the client

- Built in controls

- Handling employees queries

- Representing before the respective authorities

We help you with

Provident Fund Registration

The Employees' Provident Funds and Miscellaneous Provisions Act, 1952 is enacted to provide a kind of social security to the industrial workers. The security, however, differs from the security provided to them under the Workmen's Compensation Act or the Employee's State Insurance Act. The Employees' Provident Funds and Miscellaneous Provisions Act mainly provides retirement or old age benefits, such as Provident Fund, SuperannuationPension, Invalidation Pension, Family Pension and Deposit Linked Insurance.

Provision for terminal benefit of restricted nature was made in the Industrial Disputes Act, 1947, in the form of payment of retrenchment compensation. But this benefit is not available to a worker on retirement, on reaching the age of super annuation or voluntary retirement.

The Employees' Provident Funds and Miscellaneous Provisions Act is intended to provide wider terminal benefits to the industrial workers. For example, the Act provides for payment of terminal on reaching the age of superannuation, voluntary retirement and retirement due to incapacity to work.

ESIC Registration

We help our clients in getting ESI REGISTRATION as well as maintaining books or records as per the Act. We also help in filing annual returns, calculation of ESI, monthly payment of ESI, or in any other matter related to ESI.The Act was originally applicable to non-seasonal factories using power and employing 20 or more persons; but it is now applicable to non-seasonal power using factories employing 10 or more persons and non-power using factories employing 20 or more persons.

Under Section 1(5) of the Act, the Scheme has been extended to shops, hotels, restaurants, cinemas including preview theatre, road motor transport undertakings and newspaper establishment employing 20 or more persons. The existing wage-limit for coverage under the Act, is Rs.15,000/- per month.

Professional Tax Registration

Profession Tax is a state level tax in India on Professionals, trades, callings and employment. Profession Tax is applicable both on Individuals and Organizations (Company, Firm, Proprietary Concern, Hindu Undivided Family (HUF), Society, Club, Association Of Persons, Corporation or any other corporate body.

We help in obtaining the Certificate of Enrolment as well as in payment of profession tax along with filing statutory returns in specified times.

Service Tax Registration

Service tax is a part of Central ExciseTax in India. It is a tax levied on services provided in India, except the state of Jammu and Kashmir. The responsibility of collecting the tax is on Central Board of Excise and Customs.

Service Tax is a form of indirect tax imposed on specified services called "taxable services". Service tax cannot be levied on any service which is not included in the list of taxable services. Over the past few years, service tax been expanded to cover new services. The objective behind levying service tax is to reduce the degree of intensity of taxation on manufacturing and trade without forcing the government to compromise on the revenue needs. The intention of the government is to gradually increase the list of taxable services until most services fall within the scope of service tax. For the purpose of levying service tax, the value of any taxable service should be the gross amount charged by the service provider for the service rendered by him.

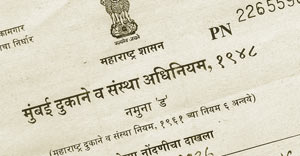

Shop & Establishment License

What is Shop and Establishment Act ?

- To regulate conditions of work and employment in shops, commercial establishments, residential hotels, restaurants, eating houses, theatres, other places of public entertainment and otherestablishments.

- Provisions include Regulation of Establishments, Employment of Children, Young Persons and Women, Leave and Payment of Wages, Health and Safety etc.

Applicability and coverage

- It applies to all local areas specified in Schedule-I

- Establishment means any establishment to which the Act applies and any other such establishment to which the State Government may extend the provisions of the Act by notification.

- Employee means a person wholly or principally employed whether directly or through any agency, whether for wages or other considerations in connection with any establishment.

- Member of the family of an employer means, the husband, wife, son, daughter, father, mother, brother or sister and is dependent on such employer.

Right to audit

Will have the right to audit the records by their internal / external auditors of the service provider.

Performance Management

All the pending work of Provident Fund, ESIC, P.Tax and MLWF will be completed in 15 days time. All amendments to the existing laws of Provident Fund, Maharashtra Labour Welfare Fund, Professional Tax and ESIC will be communicated formally by the service provider to the purchasers within a week's time for its proper compliance.

We assure you of our best services at all time.

Not found the answer?

feel free to contact our customer service for free support